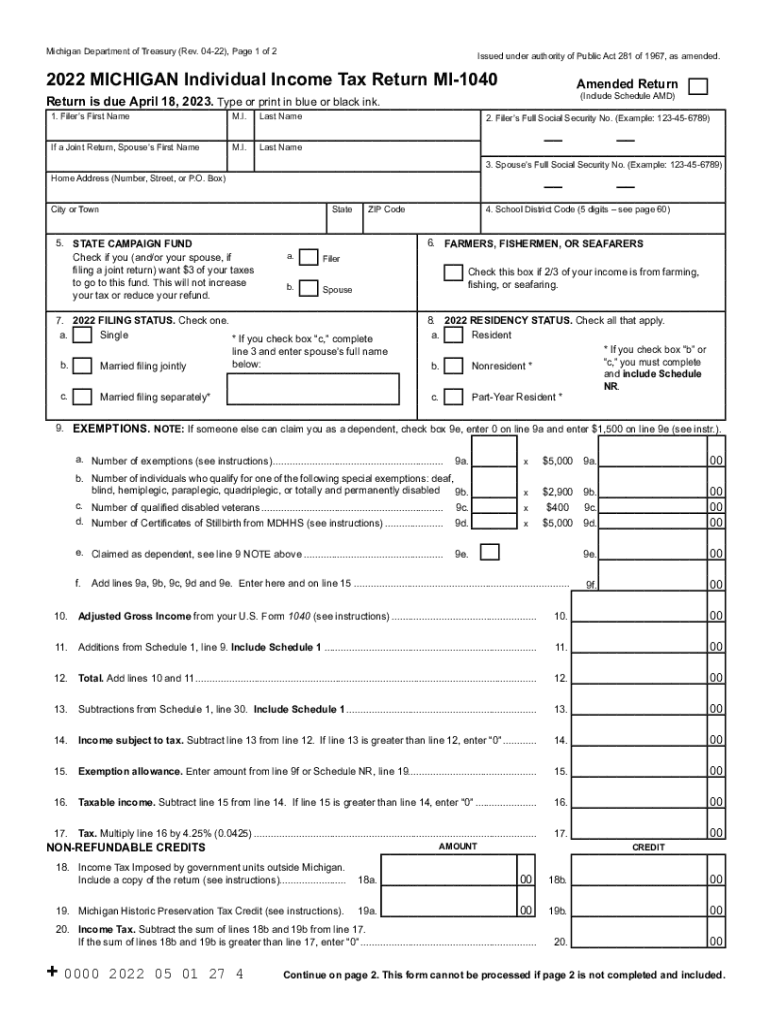

Michigan State Income Tax Rate 2025 - Michigan has a flat income tax of 4.25% — all earnings are taxed at the same rate, regardless of total income level. To What Extent Does Your State Rely on Individual Taxes?, The whitmer administration initially sought to avoid the income tax trigger through a proposal that would have diverted 2025 income tax revenue into. The income tax rate may decrease each tax year if certain economic conditions are met during the last.

Michigan has a flat income tax of 4.25% — all earnings are taxed at the same rate, regardless of total income level.

28 announced the 4.25 percent income tax rate for individuals and. Story by todd spangler, detroit free press • 1mo.

Michigan State Income Tax Rate 2025. As a result of the high tax revenues, the state's income tax rate was lowered to 4.05% from 4.25%. Michigan residents state income tax tables for single filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;.

Capitals Development Camp 2025. Not only will the washington capitals be turning its focus to […]

When you file your tax year 2023 state income tax return in 2025, you will see the rate adjustment in the form of either a larger refund or less tax owed.

Tax rates for the 2025 year of assessment Just One Lap, 2025 estimated individual income tax voucher: A law was recently passed that expands michigan’s earned income tax credit from 6 percent to 30 percent of the federal income tax credit.

Nonresidents who work in the municipality usually pay half the local tax rate.

As a result of the high tax revenues, the state’s income tax rate was lowered to 4.05% from 4.25%.

The income tax rate went back to 4.25 percent on jan.

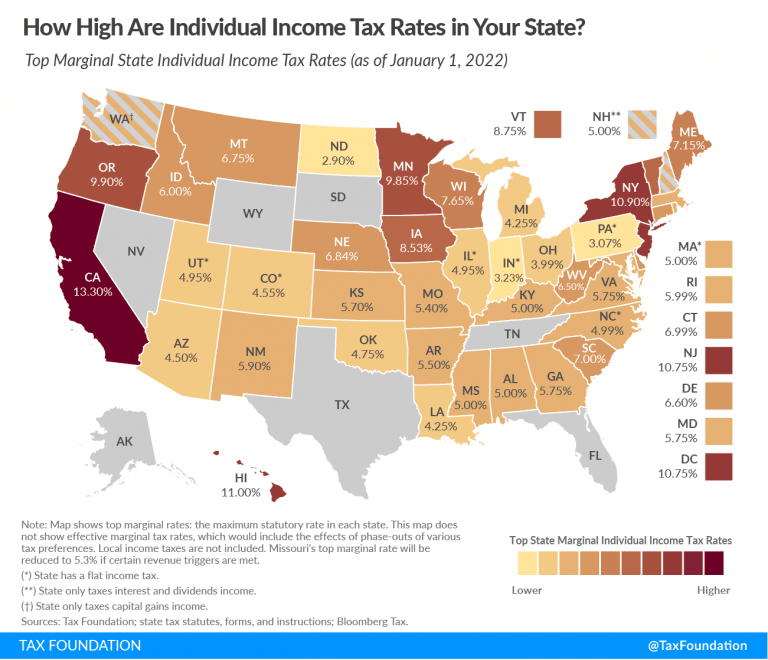

Top State Tax Rates for All 50 States Chris Banescu, When you file your tax year 2023 state income tax return in 2025, you will see the rate adjustment in the form of either a larger refund or less tax owed. 2025 michigan income tax withholding tables.

Will Michigan lower its tax rates? Here’s how we compare to other, Why did the income tax rate only change for tax year 2023? Michigan residents state income tax tables for single filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;.